Edit Content

A central bank digital currency (CBDC) is a digital representation of a fiat currency that is issued by a nation’s central bank. These regulated e-currencies are used to facilitate transactions and provide liquidity to the economy.

The benefits of using a CBDC include increased efficiency, security and transparency for financial transactions, reduced cross-border payment costs and the ability to better manage macroeconomic conditions.

As a programmable currency, they may also serve to improve financial inclusion.

Some central banks have already launched digital currencies. Others are working to develop them. In the next few years, CBDCs will enter the mainstream as a viable fiscal and economic tool.

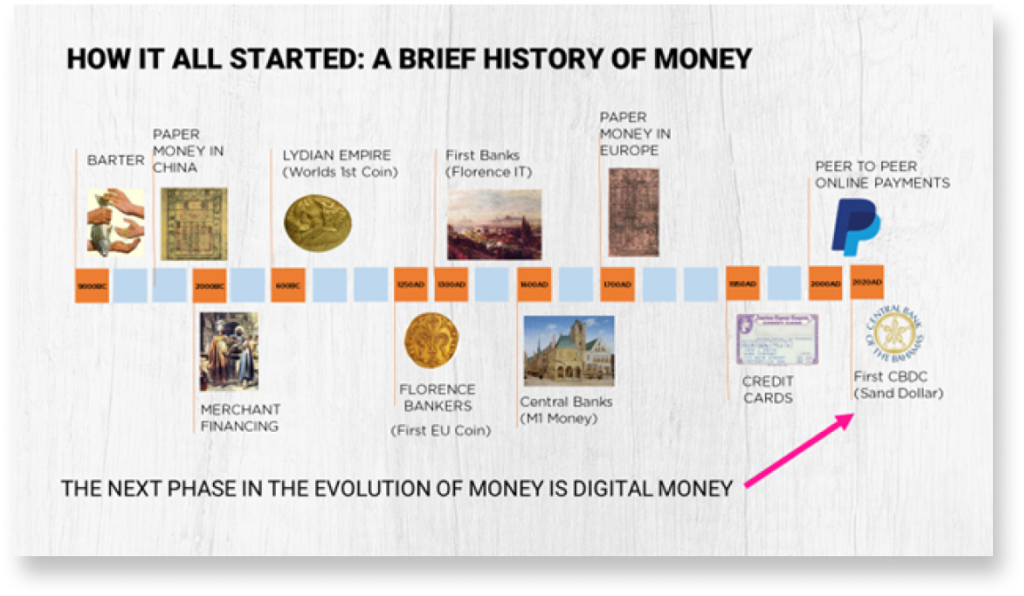

Money has come a long way since the centuries preceding the modern era when barter systems gave way to common currencies. Modern monetary theory includes digital and virtual currencies like crypto assets and, more recently, stablecoins and CBDCs.

In October 2020, The Bahamas became the first jurisdiction to release a CBDC. The Sand Dollar enhances financial inclusion, lowers payment costs and improves transactional efficiency for all in the Commonwealth.

China is the first major economy to pilot a programmable CBDC, the e-CNY, on a large scale. South Africa is piloting a wholesale CBDC with the Khokha to reduce internet bank fraud. Numerous other pilot projects are also being carried out by central banks around the globe.

Find out the latest global CBDC developments:

The introduction of CBDCs will compel banks to rake new strategic and operational decisions.

Finding the right partner to advise and implement these changes is vital to a smooth transition.

CBDCs ARE CLASSIFIED INTO TWO GROUPS WITH DIFFERENT CHARACTERISTICS:

W>CBDC (WHOLESALE)

R>CBDC (RETAIL)

Stablecoins are a type of cryptocurrency designed to maintain a stable value by pegging them to a reserve of assets, typically fiat currencies like the US Dollar or commodities like gold.

This stability makes them an attractive option for users looking to avoid the volatility commonly associated with other cryptocurrencies, as well as payments.

Key Features:

Benefits:

Stablecoins are increasingly used for trading and remittances, and institutional adoption is rapidly growing.

Learn About

Current Offerings

Trainings can be delivered both online and in-person through expert trainers.